Gov.-elect Tim Walz (D-MN) plans to include a gas-tax hike in his first budget proposal due February. His latest reason for doing so is because he received more votes than any other gubernatorial candidate in Minnesota history, so the people must want it.

“Yes, you can expect to see that,” Walz told reporters during his first visit to the State Capitol’s transition offices where he boasted of his decisive victory over Republican Jeff Johnson.

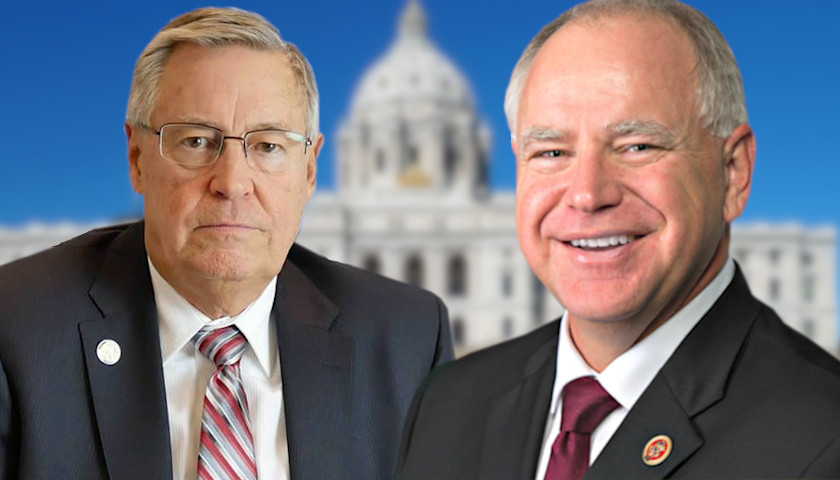

But now State Sen. Scott Newman (R-Hutchinson), chair of the Senate Transportation Finance and Policy Committee, is cautioning Walz against a gas-tax increase, which Newman says “only 35 percent of Minnesotans support.”

“I look forward to working with Gov.-elect Walz and ask him to reconsider his proposal,” Newman wrote in a Thursday press release, saying “adequate revenue” already exists “without saddling Minnesotans with higher costs at the pump.”

“With the significant improvements to gas mileage, the 20th Century gas tax is out-of-date and has become an unreliable source for increased revenue,” Newman argues, while also noting that “experts predict electric vehicles will make the internal combustion engine obsolete as soon as the next decade.”

One of the “big topics” state legislators will need to address during their next session is funding Minnesota’s transportation infrastructure, Newman writes, especially as the state prepares to begin construction on a $2 billion Light Rail extension.

But the Senate Republican has some different proposals for Walz to consider, including the use of “a portion of the existing sales on auto parts” for transportation projects.

“This is not a new proposal; in fact, this idea was given serious consideration during the last budget cycle. By dedicating a portion of the existing sales tax on auto parts and other vehicle-related services solely to transportation, we could ensure proper funding for our roads and bridges for decades to come without having to revisit the issue each budget cycle,” Newman elaborates.

He also suggests increasing the “share of current tax revenue for transportation,” giving transportation its “fair share” of the overall tax revenue.

“Right now, transportation has three principle funding sources: gas taxes, motor vehicle sales taxes, and license plate tab fees. Those are ‘user fees’ paid for by people who drive vehicles. If we took existing sales tax revenue and gave transportation its ‘fair share’ of that overall tax, all Minnesotans would be contributing to the transportation system,” Newman suggests.

According to Newman, transportation currently receives between “0.5 and 0.7 percent of the tax revenue,” but if that were increased to 1.5 percent, then “transportation would receive more than $600 million per year in additional funding.”

“The reality is additional funding for our roads and bridges will be necessary and it doesn’t make sense to tie that need to a funding source that will become unreliable,” Newman concludes. “I join most Minnesotans in vehemently opposing a gas tax increase and am hopeful the governor-elect will consider viable alternatives that do not raise taxes and fees of Minnesotans.”

– – –

Anthony Gockowski is managing editor of Battleground State News and The Minnesota Sun. Follow Anthony on Twitter. Email tips to [email protected].

Photo “Scott Newman” by Scott Newman.